Categories

Sustainability reporting

Updated: February 2024

Table of contents

Available reporting frameworks

Adding, editing, and viewing data

Overview

Our reporting system is built to align with the sustainability frameworks you select. Whether you choose CDP, TCFD, GRI, CSRD ESRS E1 or other frameworks, we automatically format the data you enter in the Measure section of the app to meet the specific reporting requirements of your chosen frameworks.

How-to guide

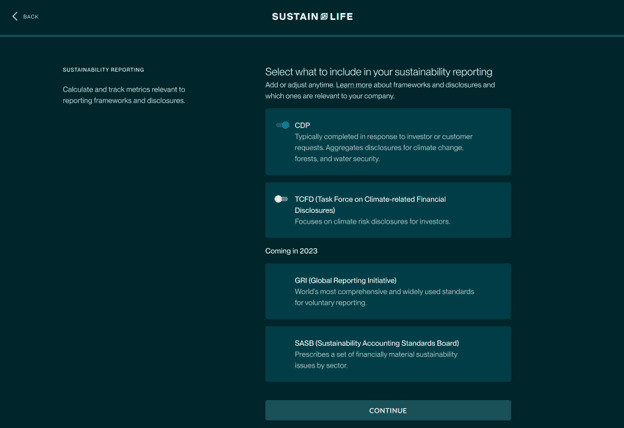

Onboarding

When you first onboarded, you would have seen the option to select the frameworks that you want to track against if your main goal was to calculate your emissions. If you selected one of the frameworks at this point, you will also see those frameworks toggled on in the reports section, and your default configurations for each location will be set based on what fields are applicable to each framework/disclosure selected. To change these selections, see the next section.

Reports section selection

From the Report tab, select Sustainability reporting.

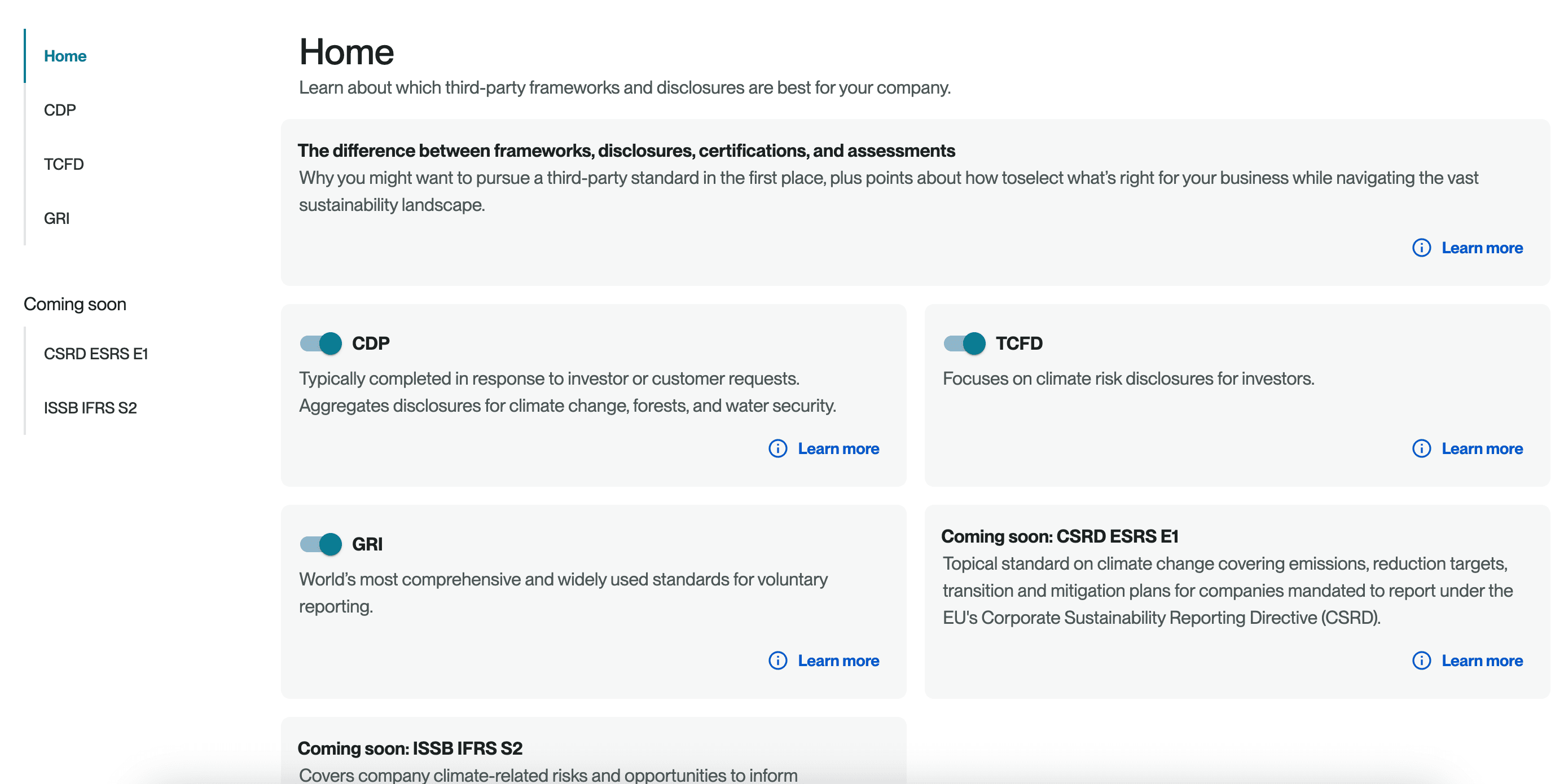

This section is your hub for all things sustainability reporting. You can learn more about the difference between frameworks, disclosures, certifications, and assessments from this page. You can also select frameworks that are relevant to you by using the toggle on the top left of each framework card, and see what disclosures are coming soon. The left navigation is how you dive deeper into a single framework.

Available reporting frameworks

We currently support CDP, TCFD, GRI, and CSRD ESRS E1 so you can select any of these to see the related reporting tables.

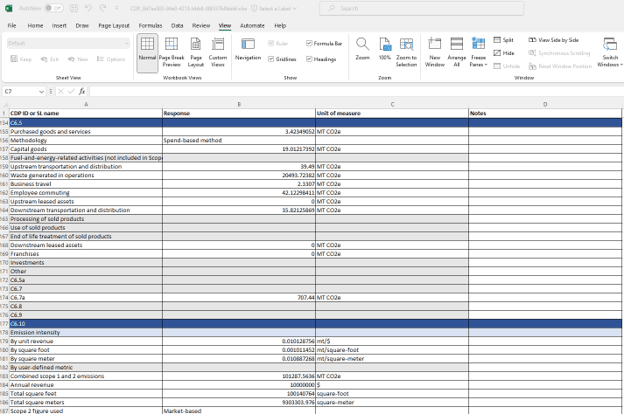

CDP: Typically completed in response to investor or customer requests. Aggregates disclosures for the climate change survey for sections C4, C5, C6, C7, and C8. CDP reports take time to complete through their portal and, while this Sustainability reporting feature dramatically streamlines the process, we recommend that you give yourself ample time to complete the CDP survey.

TCFD: Focuses on climate risk disclosures for investors. We provide the quantitative outputs for TCFD pillars 4b and 4c.

GRI: World's most comprehensive and widely use standards for voluntary reporting. We provide the quantitative outputs for General Disclosures, Economic Performance, Energy, Water and Effluents, Emissions, Waste, and Diversity and Equal Opportunity.

CSRD ESRS E1: Topical standard on climate change covering emissions, reduction targets, transition and mitigation plans for companies mandated to report under the EU's Corporate Sustainability Reporting Directive (CSRD). We provide quantitative outputs on relevant targets, fuel consumption, emissions, and carbon credits.

Please note that the outputs that we provide for these frameworks are not exhaustive, since we can only provide data for the indicators you track in our app. For example, a full CDP report includes information on your various decarbonization initiatives and climate risks and opportunities. While the bulk of TCFD is made up of descriptions of your policies and plans when it comes to climate risks and opportunitities. We can only produce data for you if it is data that we already store in our app. This means that the data we provide to you for these fraweworks is emissions data and carbon targets data (if you've saved carbon targets in our app). In the future, we will be releasing new features for understanding your climate risks and opportunities as well as tracking decarbonization initiatives. As we develop new features, you will be able to export any data you save in them for these frameworks.

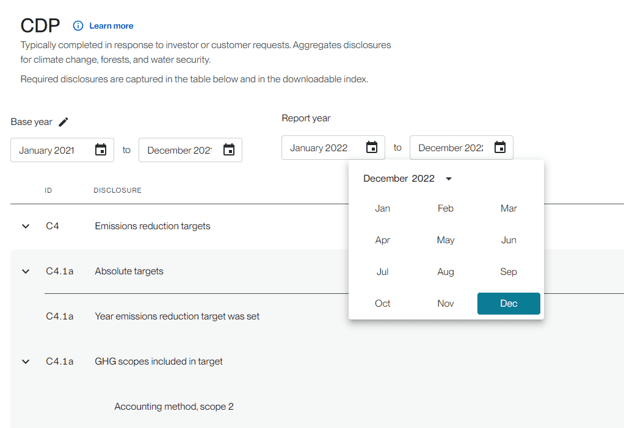

Selecting your time frame

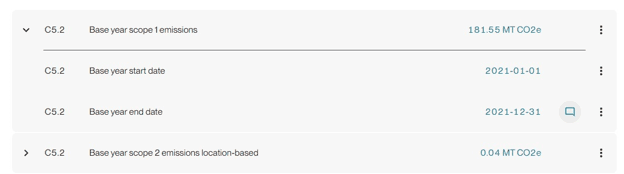

Once you have selected your from the left nav, you will land on that framework's page and see a data table. Your first step is to select your base year and reporting timeframe. The reporting year is the date range/year that you are using for your report.

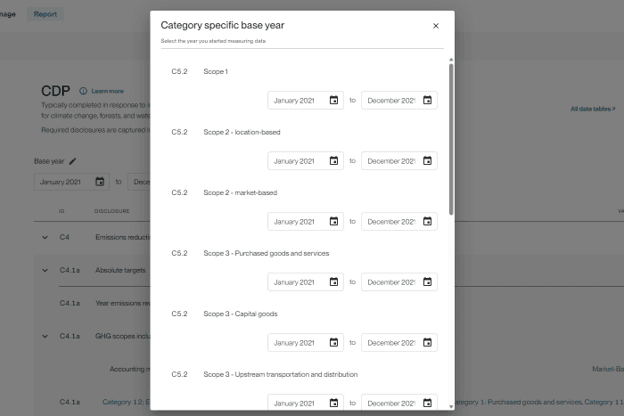

In specific sections of the CDP table you can also change your base year. Many companies have different base years for different emissions categories. For instance, customers may have been tracking Scope 1 and Scope 2 for five years, but only started tracking business travel and commuting two years ago and maybe this year they’re adding PGS. Those companies would have three different base years in that scenario. Because CDP allows for it, it makes it easier for companies not to have to change their base year and abandon all their previous performance tracking every time they add another Scope 3 category. Few companies tackle all categories at once in the same year. You can do this directly from the table or from the edit symbol at the top near base year to pull up the following modal:

Marking something as relevant

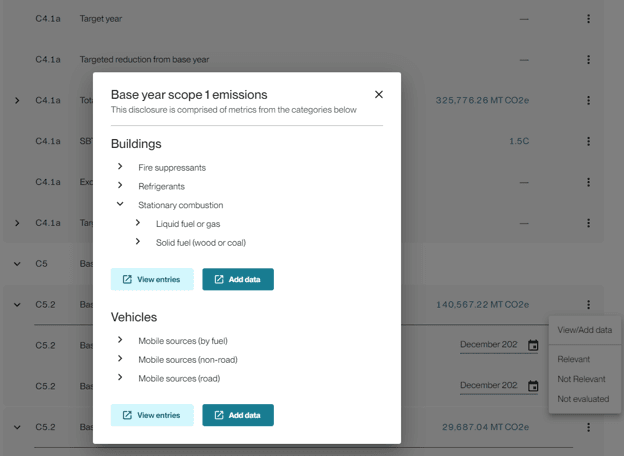

Each row of data has a three dotted kebab at the end where there are several options, including the ability to mark a data point as:

- Relevant

- Not relevant

- Not evaluated

These correlate to your own reporting, meaning you can select any of these options as they pertain to your company. We include them because CDP asks for them for each datapoint, so, if you'd like, you can choose your relevance evaluation here.

Adding, editing and viewing data

From the kebab on the right, you can also view/add data for a specific line. A modal will appear that explains what metrics the disclosure line item is comprised of, and you can open the accordion to view more details/understand the deeper levels.

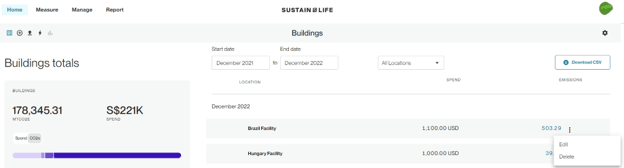

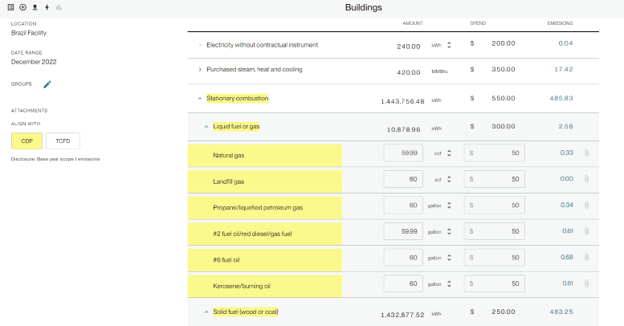

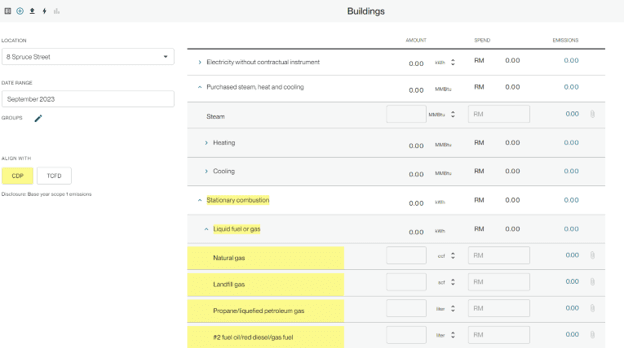

View entries

If you click View entries from this modal, a new tab will open and you will be brought to the ledger page in the relevant category, filtered to the correct start and end date based on your reporting year. When you delve deeper into one of these specific entries, the selected framework will be highlighted with a note underneath that names the data point you selected/entered from—e.g. if CDP is highlighted, and the selected data point is described below as Disclosure: Scope 1 – Stationary Combustion. You will also see that the pieces of data that go into that calculation are highlighted in the form as well. This is meant to be a helpful guide to ensure you know what information has gone into each calculated field.

You can add data directly from this page, via bulk upload, or through integrations.

Notes and attachments

At a line item level in the table customers can also add attachments and notes by clicking the small post-it icon. These are important for record keeping, additional details, etc. It if your choice if you want to include these notes in your submission to CDP, your TCFD report, etc.

Downloading the content index

Customers can easily download all the information in the table plus additional breakout information that is necessary for some disclosures by clicking the Download button on the top right. An excel file that has all the framework data point names, your values, and additional details including notes will be generated.

Definitions

Carbon Disclosure Project (CDP) - An international non-profit that facilitates annual carbon emissions and emissions-related disclosure through their Climate Change survey. Companies can report to the survey voluntarily or they may be asked to report to it by an investor or another company in their supply chain (usually a customer).

Taskforce on Climate-related Financial Disclosures (TCFD) - An international organization that develops recommendations on how companies disclose their climate-related risks and opportunities for investors, shareholders, and the public, so that they can adequately access and price financial risks and financial impact related to climate change.

Global Reporting Initiative (GRI) - The Global Reporting Initiative (GRI) is an international, independent not-for-profit organization that provides widely-adopted sustainability reporting standards. GRI reporting is voluntary but enables diverse companies to be more transparent about their economic, environmental, and social impacts. Overwhelmingly, the GRI Standards have emerged as the preferred reporting tool among top companies. A KPMG report on sustainability reporting tools in 2022 showed that 78% of the world’s 250 largest companies published GRI reports, up from 73% in 2020. 96% of the top 250 listed companies report on their ESG and sustainability activities.

CSRD ESRS E1: Topical standard on climate change covering emissions, reduction targets, transition and mitigation plans for companies mandated to report under the EU's Corporate Sustainability Reporting Directive (CSRD).

FAQs

Is Workiva Carbon able to electronically transmit my CDP submission for me?

In 2024, CDP will launch a new disclosure framework on a new technology platform that will allow accredited software providers like Workiva Carbon to submit data automatically on behalf of its customers to CDP via an API. The API will be part of a new disclosure platform which aims to streamline the disclosure experience for organizations and enable CDP to scale up disclosure exponentially. The API will be a key part of helping to facilitate disclosure, reducing the need for manual entry.

The new platform will open in April 2024 and at that time, Workiva Carbon will plan to build in support for this integration.

Can Workiva Carbon help me prepare the other data I need to complete the CDP or TCFD reports?

This feature is only capable of outputting data that you are storing in our app. In general, that means we support the emissions, energy, and carbon target portions of CDP and TCFD. As we develop new features and add them to our platform to support developing other types of sustainability reporting (such as climate risks and opportunities), their outputs will become available in this feature.

What is the CDP disclosure cycle timeline?

The disclosure period opens in early June 2024 and closes in September 2024.

What other frameworks and disclosures does Workiva Carbon plan to support in the future?

We plan to launch support ISSB IFRS S2 in Q3 2024. We also plan to support submissions from private equity companies on behalf of their portfolio companies to the ESG Data Convergence Initiative (EDCI).

Can Workiva Carbon help me fill out framework selections related to my climate risks and opportunities and decarbonization initiatives?

Currently, we only support sections related to quantiative metrics you already track in the application, but as we launch new features around decarbonization initiatives and climate risks and opportunities (planned for later in 2024), we will incorporate them into the Sustainability reporting feature.

Does Workiva Carbon support alignment to California bill SB 253 (the Climate Corporate Data Accountability Act) and/or the SEC cilmate disclosure rule?

These mandates have not yet been finalized, but we will build in support for them once they take effect.

Copyright 2026 Sustain.Life All rights reserved