Categories

Consolidation Method & Operational Control

So companies can accurately report combined emissions, "consolidation" combines the greenhouse gas emissions from an organization’s various sub-entities (“child” entities) according to specific rules, so companies can accurately report combined emissions.

Updated: February 2023

Table of contents

Picking your consolidation approach

Overview

Consolidation in emissions accounting

Consolidation in emissions accounting is the process of combining emissions data from business entities—subsidiaries, franchises, and joint ventures—and rolling them up to the parent company for reporting purposes. In complex owner or operatorship structures, legal and accounting teams can help align the organization's emissions consolidation approach with its financial consolidation approach. All companies preparing an emissions inventory should select a consolidation method prior to developing an emissions inventory.

Why choose a consolidation method?

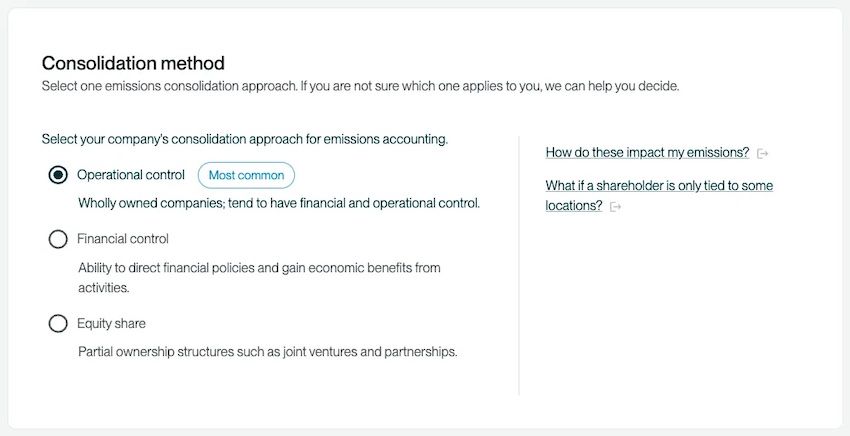

As in financial accounting, there are rules in emissions accounting to ensure accuracy when reporting combined results. Selecting a consolidation approach is part of setting organizational boundaries. When that approach is consistently applied to all entities, your emissions will be properly categorized without double-counting. If your organization wholly owns its entity or entities, select either approach (control or equity share) to get the same results. In these cases, operational control is the most common method.

Selecting a consolidation approach is a lasting decision. Although the approach may be changed, and indeed should change if the business structure changes, the same approach should be used year after year to allow for consistent emissions performance tracking over time. Changing your consolidation approach in the future may require recalculation of previous years’ inventories.

Based on the structure of the organization and the consolidation approach, different sources of emissions may be categorized under different scopes or be left uncounted entirely. When you select a consolidation approach, Workiva Carbon uses that information to select the proper emissions category for you.

Consolidation approaches

1. Control approach

As the name implies, this approach indicates that you have control over an entity’s operations. The control approach is further divided into: a.) Operational control, and b.) Financial control

For wholly-owned companies that direct financial and operating policies, it’s recommended to select operational control. Financial control indicates the ability to direct financial policies in return for potential economic benefits. Companies with operational control have full authority to introduce and implement operating policies, including environmental policies.

2. Equity share approach

This approach is common in organizations that hold shares of equity in one or more entities. For example, a company that holds a 50% share in a joint venture is only responsible for 50% of its emissions.

Disclaimer: The recommendations here are suitable for most organizations with common ownership/ operatorship structures. If your ownership structure is complex and you’re heavily regulated or participate in emissions trading schemes (e.g., oil and gas companies, financial firms), consult your legal, finance, and accounting teams to determine the best consolidation approach.

How-to guide

To select your consolidation method, go to the settings in the top right corner of the screen, then select “Company profile” and scroll down to the bottom of the page.

Picking your consolidation approach

Choose the emissions accounting consolidation approach for the parent company (meaning the company that controls any subsidiaries, if applicable) and apply it consistently across all child entities (again, any subsidiaries of the company). You can select only one option. If you’re unsure, use the following guidance to decide.

If you control the operating policies for most of your operations (e.g., policies that impact production or service delivery or health, safety, and environmental policies) and you’re not a franchisor: Select the operational control approach. Workiva Carbon will account for 100% of the emissions generated by entities whose operating policies you control. Under this approach, exclude from your inventory any operations in which you have economic interest, but whose day-to-day activities you can’t control.

You do not control the operating policies for most of your operations (e.g., policies that impact production or service delivery or health, safety and environmental policies) and you’re not a franchisor: Select the financial control approach. Workiva Carbon will account for 100% of the emissions generated by your group companies and subsidiaries regardless of your equity share. Joint ventures and partnerships are accounted for according to your economic interest, not at 100%. Exclude associated companies and fixed assets from your inventory (i.e., entities you influence but do not control).

If you’re a public sector organization: Select operational control approach per the Public Sector Standard. Workiva Carbon will account for 100% of the emissions generated by your controlled entities.

If you’re a financial services company adhering to PCAF: PCAF requires using either the operational or financial control approach. Workiva Carbon will account for 100% of the emissions generated by your consolidated entities, even if you don’t wholly own them.

If your company has multiple owners (e.g., joint venture, LLP): Select the equity share approach. Workiva Carbon will account for emissions based on your share of economic interest in each entity.

If you’re a franchisor with no equity rights in your franchise and you do not have operational and/or financial control over the franchise (common): Workiva Carbon won’t account for any of your franchise emissions under scope 1 or 2. Instead, Workiva Carbon will categorize them as Scope 3: Franchises. It‘s recommended that you collect primary data from your franchisees. If you want to compute emissions for a location for which you manage your franchise business (and any other businesses), treat this as a separate entity.

If you’re a franchisor with equity rights in your franchise (uncommon): The equity share approach is recommended. Workiva Carbon will account for the emissions based on your share of economic interest in the franchise.

If you’re a franchisor with no equity rights in your franchise but you have the authority to implement operating policies (uncommon): Select the operational control approach. Workiva Carbon will account for 100% of the emissions generated by franchises whose operating policies you control. Under this approach, exclude from your inventory any operations in which you have economic interest, but whose day-to-day activities you can’t control.

If you’re a franchisor with no equity rights in your franchise but you have the authority to direct financial policies (uncommon): Workiva Carbon recommends the financial control approach. Workiva Carbon will account for 100% of the emissions generated by franchises you financially control.

If you’re a franchisor with no equity rights in your franchise but you have the authority to direct financial and operating policies (uncommon): Workiva Carbon recommends the operational control approach. Workiva Carbon will account for 100% of the emissions generated by your franchise.

FAQs

How does the consolidation method impact my emissions inventory?

Selecting a consolidation method is an emissions accounting principle that supports transparency and accuracy. In many cases, the consolidation approach you select won’t impact your greenhouse gas emissions inventory. But if you lease assets, have partial ownership in entities, or have financial interest (even minority interest) in an entity that affords you control, the consolidation approach may determine the percentage of emissions included in your inventory and the categorization of certain emissions in either scope 1 and 2, or in scope 3.

How is our equity share reflected in emissions outputs?

Workiva Carbon simply multiplies an entity’s total emissions by your equity share to create your inventory. When you have multiple entities, Workiva Carbon rolls up the appropriate percentage of emissions from each entity into your total organizational emissions inventory.

What if our equity share fluctuates?

For year-over-year fluctuations, update your share in Workiva Carbon each year. Your emissions outputs will fluctuate accordingly. For fluctuations throughout the year, develop an annual average.

We’re an LLP with too many partners to break them all out as separate entities under the equity share approach. What should we do?

Keep in mind that the purpose of an emissions inventory is to provide your stakeholders with impact data. If you’re an LLP with dozens or hundreds of partners (e.g., a large law firm), each partner probably doesn’t have separate investors who are all asking for separate inventories. In these cases, it makes sense to report emissions for 100% of the LLP and explain the organizational structure for context.

What if one or more entities in our organization have already selected a consolidation approach, but we want to use a different one?

If your parent company has adopted an approach, apply the same approach to your entity, even if you disagree with it. If entities other than the parent have chosen one or more approaches you disagree with, the best course of action is to discuss it with legal and accounting teams at the parent level and ensure that the entire organization agrees to and adopts the same approach. This will also prepare you for external verification of your companywide emissions inventory down the road.

What are the advantages of each approach?

-

Control approach:

-

You take full ownership of emissions you can directly influence and control

-

The ability to hold managers accountable for their respective operations (under the operational control approach)

-

The ability to meet minimum operational data quality standards

-

-

Equity share approach:

- Your emissions inventory fully aligns your impacts with your economic interests, including associated companies over which you have no financial control

- Partners in joint ventures are all taking responsibility for their share of emissions

What are the disadvantages of each approach?

-

Control approach:

- Exclusion of partially owned entities you don’t control, which, if applicable, results in an incomplete view of the organization’s climate impacts

- Equity share approach:

- Preparation of a GHG inventory is more complex because data may be difficult to obtain for the entire entity, especially if you hold a minority interest

- Emissions need to be allocated to reflect your share of equity, but we can do this for you

What percentage of emissions are accounted for in the financial control approach by company type and how does this compare to equity share?

| Entity type | Emissions allocated under equity share approach | Emissions allocated under financial control approach |

|---|---|---|

| Group companies, subsidiaries | Equity share | 100% |

| Affiliated/associated companies | Equity share | 0% |

| Joint ventures/partnerships | Equity share | Equity share |

| Fixed asset investment | 0% | 0% |

| Franchises* | Equity share | 100% |

Franchises are legally separate entities and should not be included in franchisor’s consolidation unless the franchisor has equity rights or financial/operational control (as assumed in the table above).

For which scenarios is choosing the right consolidation approach most important?

-

Partially owned entities

-

Complex organizational structures (e.g., subsidiaries of subsidiaries not wholly owned, oil and gas companies, financial institutions)

-

Entities that lease assets (e.g., building space, vehicles)

-

Uncommon franchise structures where the franchisor exerts control over finances or operations or holds equity

-

Public sector organizations

-

PCAF-aligned financial institutions

Which approach is easiest to align with our financial accounting practices?

The financial control approach and the equity share approach can both be aligned with your financial accounting consolidation approach.

If I change my consolidation method after entering data in Workiva Carbon, what will happen to my previous entries?

If you change your consolidation method at any point, that will only impact data entries from that point going forward. Any previously entered data will not be updated. If you’d like historical data to update as well, reach out to Customer Support.

What stakeholders in a business typically decide the consolidation method? When would a client typically engage a consulting professional to make this decision?

In companies with complex organizational structures (e.g., several subsidiaries, complex ownership or operatorship), this is typically a multi-stakeholder executive decision, involving legal counsel and accounting leaders. But even in simple organizational structures, it’s common to have a senior leader confirm the approach. It’s always advisable to involve someone who prepares the company’s consolidated financial statements.

How do you define operational control for over an asset (site/facility/vehicle/equipment, etc.)?

To conform to the definition of operational control, only one (1) of the conditions listed below needs to be met:

- Do you have the authority to introduce operating policies to the space? For example, are you able to adjust thermostat settings, carry out tenant fit-outs that involve upgrading your lighting or HVAC systems, etc.

- Do you have the authority to introduce health & safety policies to the space? For example, ensuring maintenance, such as, HVAC, water and plumbing, etc. maintenance procedures are in place to ensure the well-being of your employees.

- Do you have the authority to introduce environmental policies to the space? For example, policies involve upgrading/replacing major infrastructure, such as central cooling/heating systems (or similar systems), to ensure compliance with environmental regulations.

What happens when I don't have operational control over the asset I'm leasing (applies to both lessee and lessor)?

*Reference "Lessee" or "Lessor" questions below if you have identified that you do have operational control over the asset in question.

When you don't have operational control, energy and/or fuel consumption would be classified under Scope 3. It'd be GHGP Category 8 for Lessee's and GHGP Category 13 for Lessor's. Please note, you will be expected to provide concrete evidence if operational control of a facility is not held.

If you are the lessee of an asset (facility, vehicles, machinery, etc.), what should I be asking myself to determine if the fuel and/or energy consumed by the asset should fall under Scope 3?

If you're using Equity Share or Financial control to define your consolidation approach and your lease is an operating lease. Then your resource consumption (i.e, electricity, natural gas, etc.) gets classified into Scope 3 Category 8 (guidance from GHGP's Appendix F).

If you are the lessee of an asset (facility, vehicles, machinery, etc.), what should I be asking myself to determine if the fuel and/or energy consumed by the asset should fall under Scope 1 & 2?

-

If you're using Operational control to define your consolidation approach and your lease is a finance/capital lease. Then your resource consumption (i.e, electricity, natural gas, etc.) gets classified into Scope 1+2 (guidance from GHGP's Appendix F). This is the most common scenario.

-

If you're using operational control to define your consolidation approach and your lease is an operating lease. Then your resource consumption (i.e, electricity, natural gas, etc.) gets classified into Scope 1+2 (guidance from GHGP's Appendix F).

-

If you're using Equity Share or Financial control to define your consolidation approach and your lease is a finance/capital lease. Then your resource consumption (i.e, electricity, natural gas, etc.) gets classified into Scope 1+2 (guidance from GHGP's Appendix F).

If you are the lessor of an asset (facility, vehicles, machinery, etc.), what should I be asking myself to determine if the fuel and/or energy consumed by the asset should fall under Scope 3?

-

If you're using Operational control to define your consolidation approach and your lease is an operating lease. Then your resource consumption (i.e, electricity, natural gas, etc.) gets classified into Scope 3 Category 13 (guidance from GHGP's Appendix F). This is the most common scenario.

-

If you're using Operational control to define your consolidation approach and your lease is an finance/capital lease. Then your resource consumption (i.e, electricity, natural gas, etc.) gets classified into Scope 3 Category 13 (guidance from GHGP's Appendix F).

-

If you're using Equity Share or Financial control to define your consolidation approach and your lease is a finance/capital lease. Then your resource consumption (i.e, electricity, natural gas, etc.) gets classified into Scope 3 Category 13 (guidance from GHGP's Appendix F).

If you are the lessee of an asset (facility, vehicles, machinery, etc.), what should I be asking myself to determine if the fuel and/or energy consumed by the asset should fall under Scope 1+2?

If you're using Equity Share or Financial control to define your consolidation approach and your lease is an operating lease. Then your resource consumption (i.e, electricity, natural gas, etc.) gets classified into Scope 1+2 (guidance from GHGP's Appendix F).

Copyright 2025 Sustain.Life All rights reserved